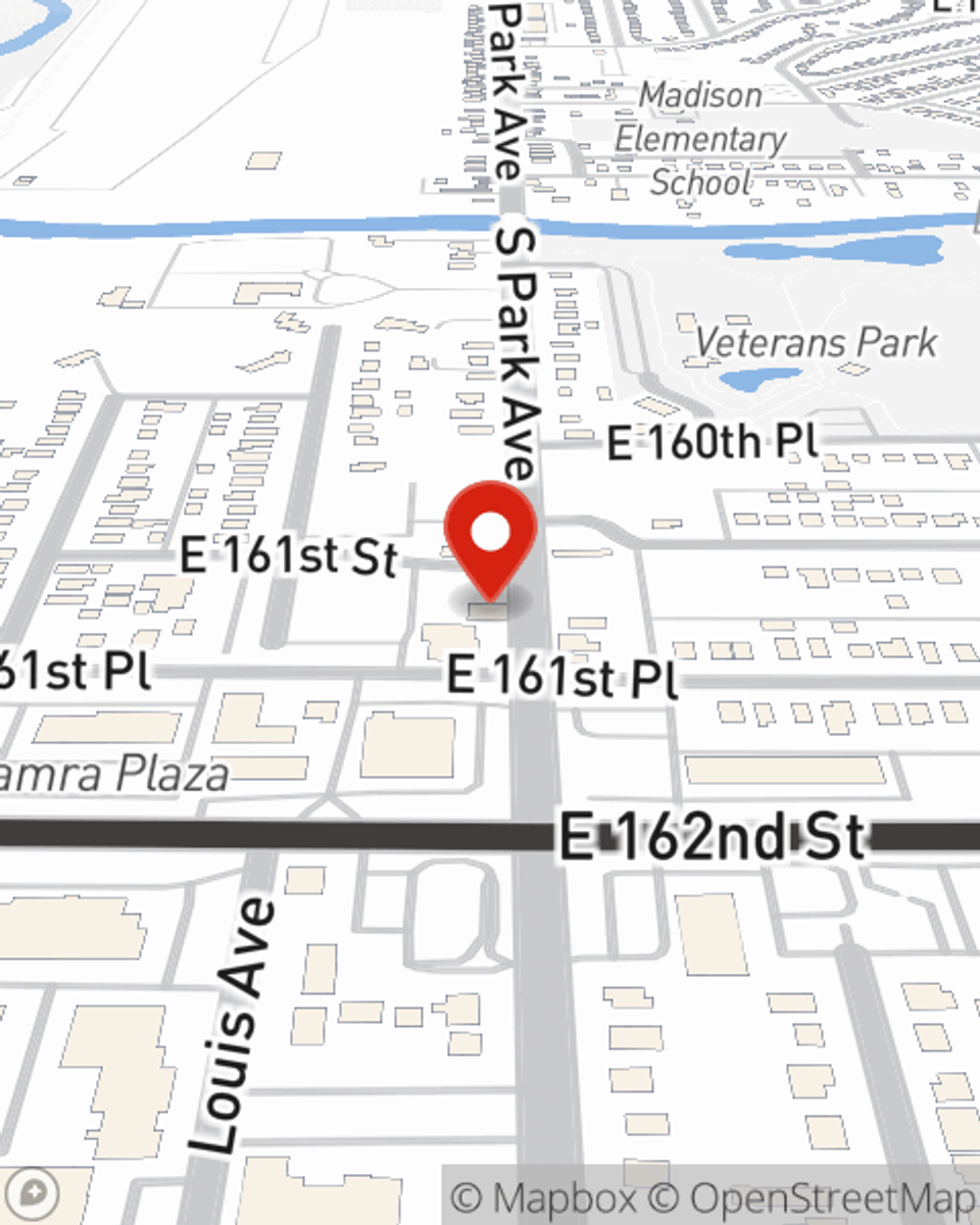

Renters Insurance in and around South Holland

Welcome, home & apartment renters of South Holland!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through coverage options and deductibles on top of managing your side business, family events and work, can be a lot to juggle. But your belongings in your rented home may need the remarkable coverage that State Farm provides. So when the unexpected happens, your mementos, furnishings and appliances have protection.

Welcome, home & apartment renters of South Holland!

Rent wisely with insurance from State Farm

There's No Place Like Home

You may be wondering: Is renters insurance really necessary? Just pause to consider what would happen if you had to replace your personal property, or even just a few of your high-value items. With a State Farm renters policy in your pocket, you won't waste time worrying about thefts or accidents. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Marcus Jackson can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a committed provider that can help with all your renters insurance needs, contact State Farm agent Marcus Jackson today.

Have More Questions About Renters Insurance?

Call Marcus at (708) 893-0574 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Marcus Jackson

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.